Help on: SEPA direct debit

Enter a SEPA direct debit in this dialogue box.

For an explanation of specific elements within the form, simply click the number and marker that correspond to that element.

Information about the initiator: Please enter the following information which will apply for the entire order and thus for all payment records contained in this order:

- Originator's account: Here you will see all of the originator's accounts for the relevant bank access for which you have authorisation and which you can use for this payment type.

- If the originator's account is linked to a company, data is transferred from the company profile.

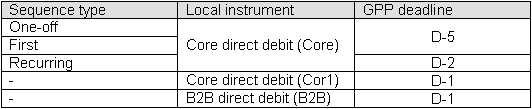

- The requested collection date is the day it is debited from the payer's account. This is subject to certain presentation deadlines depending on the direct debit and sequence type. When defining the presentation deadline, please note that other users of that customer may have to approve the order and that this would result in a delay in order processing.

- Under local instrument you can choose between Core and Cor1 direct debits and B2B direct debit types. You must have permission for the EBICS order type CDD (Core) or CD1 (Cor1) in order to enter a core direct debit. B2B direct debits require permission for the CDB order type on the bank's computer system.

The sequence type indicates whether this is a one-off, the first or a recurring collection.

- Enter the booking type to determine whether the total amount should be credited to the originator's account or whether you want a separate credit entry for each payment record.

- An optional customer reference for the whole payment order.

Complete order processing: Click here to complete order processing. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. You will also be shown the order number assigned by the bank's computer system upon receipt.

Orders sent to the bank's computer system are then displayed under history.

Debtor information: Please enter the debtor's name, address (optional) and IBAN as well as the bank's Swift-BIC. If the Swift-BIC provided is valid, the bank's name will be displayed. For domestic SEPA payments Swift-BIC of the debtor is optional ("IBAN Only"). This does not apply to client accounts in non-EUR countries (e.g. Great Britain). Here's imperative to specify Swift-BIC for both domestic and cross-border payments.

As you enter a beneficiary's name, suggestions from your address book will appear automatically which you can then use to select a bank connection or template. You can also select a bank connection that you already used for a past order. Alternatively, click the Select Contact function to access your address book and search for bank connections and templates.

Direct debit information: SEPA direct debits are carried out in euros. The mandate reference and date of mandate must also be specified. The end-to-end reference entered is forwarded to the debtor of the payment.

The purpose can be specified in either a structured or unstructured format. We recommend that structured purposes only be used after consultation with the beneficiary.

Additional information: Optional information can be specified under the payment record's Additional Information. There you can select the purpose or enter information regarding the ultimate originator or beneficiary..

Save order as a template: Click here to save this order as a template. Templates will always be saved under a contact's bank connection in your address book. You can choose whether to

- save the template under an existing bank connection or

- use the beneficiary's details to create a new bank connection for an existing contact or

- automatically create a new contact with this bank connection.

Create a collective order: Add additional payment records to the order to create a collective order. The information provided under the originator's details will apply for all payment records included in this order. The total amount of the order is updated automatically.

Save Order: Save the order to edit it again at a later point in time. Saved orders can also be edited by other users of that customer if they are authorised for the relevant order type and the originator's account specified in the order.

Saved orders can be found under orders in progress.

Complete order processing: Click here to complete order processing. After this you will have an opportunity to re-check the order details and submit the order by providing your signature pin. You will also be shown the order number assigned by the bank's computer system upon receipt.

Orders sent to the bank's computer system are then displayed under history.