Dear Customer,

The interbank offered rates (IBOR) have been the cornerstones of daily business in the global finance industry and of the key reference rates. They have been the baseline for countless banking products from derivative transactions through loans to the pricing of securities. However, the time has come to take our leave of the old system of interbank offered rates.

What is the historical background of the current transition?

The G20 governments commissioned the review and reform of the system in 2013. This included the development of a new system to improve transparency, fairness and the efficiency of markets subsequent to which the European Union adopted a new binding regulation on the calculation methodology of reference rates.

In 2017, the UK Financial Conduct Authority (FCA) decided that it would no longer require banks to offer LIBOR rates after 2021, because they do not comply with the new EU regulation anymore. This action required the development of a new benchmark applying to the whole sector.

Based on the recommendations of the Financial Stability Board (FSB), the international organisation monitoring the operation of the global financial system, the countries established national committees to develop the new interest rate benchmarks.

The extensive range of currency areas worked on the review of the associated systems and developed the new reference rates applicable from 2022, also defining the roadmap and method of their implementation. This practically means that IBORs and other key reference rates will be replaced by so-called risk-free rates (RFRs) from January 2022 onward.

The European Commission already adopted implementation regulations for the replacement of the Swiss Franc London Interbank Offered Rate (CHF LIBOR, adopted 14 October, 2021) and the Euro Overnight Index Average (EONIA, adopted 21 October, 2021).

The transition away from IBORs to RFRs and the associated changes affect a wide range of financial products during fixing.

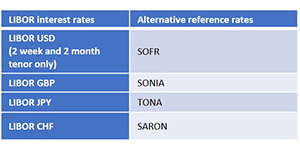

What are the current and new reference rates affected from 1 January 2022?

What does this mean for you?

In compliance with the regulatory requirement, the financial sector discontinues the use of IBOR based reference rates at the end of 2021. Accordingly, our Bank took or takes the following measures:

- We amended Section 6.4 of our General Terms of Business in December 2020 (please see on our website www.commerzbank.hu under Terms ) to regulate the application of future reference rates in conformity with the regulation on the phased out interest rates.

- As of 1 January 2022, the new reference bases will apply to credit facilities and sigh deposits associated with the above interest rates

- If no binding regulation is issued, we will proceed according to the above referred section of our General Terms of Business. There are no actions necessary on your side.

If you have any comments or questions regarding the above, please submit it to your dedicated contact person in writing.

Sincerely,

Commerzbank Zrt.